By Steve Whitehill, Anchor Business Advisors

If you have questions after reading this series please feel free to contact us.

In part 1 we discussed what you got the PPP loan for and what you can use the money for. In this installment, we will be filling out part of the loan forgiveness application, SBA from 3508. The application itself is 11 pages long many of these pages are instructions. Page 3 of the Application is where the Loan Forgiveness Calculation is actually done. Page 4 contains Representations and Certifications not unlike those signed in your application for the PPP Loan but tailored to the loan forgiveness application. Page 3&4 are really the loan forgiveness application everything else supports these two pages. While in theory you might be able to complete these pages without going through the full process, if you do that you are likely to do it wrong, calculate the wrong forgiveness and not submit all the required information.

In the following I will discuss the how to complete the SBA from 3508 Loan Forgiveness Application using a case Study and information developed by MBAF CPA & Advisors.

Case Study Facts & Assumptions:

A though Z & the Kitchen Sink Inc. is a (Sub Chapter) S Corporation and is 100% owned by John Smith. It had the following employees for 2019:

| Employee | 2019 Gross Annual Compansation | 2019 Gross Compensation Capped at $100K | 2019 Health Insurance | 2019 Avg Hours per Week | 2019 Total Compansation* | 2019 FTE Head Count |

| John (the owner) | 50,000 | 50,000 | 10,000 | 60 | 60,000 | 1.0 |

| Bob | 60,000 | 60,000 | 7,500 | 30 | 67,500 | 0.8 |

| Sarah | 90,000 | 90,000 | 7,500 | 40 | 97,500 | 1.0 |

| David | 30,000 | 30,000 | 7,500 | 20 | 37,500 | 0.5 |

| Emily | 110,000 | 100,000 | 10,000 | 45 | 110,000 | 1.0 |

| Frank | 80,000 | 80,000 | 7,500 | 45 | 87,500 | 1.0 |

| Gracy | – | – | – | – | – | – |

| Henry | 95,000 | 95,000 | 7,500 | 40 | 102,500 | 1.0 |

| Totals | 515,000 | 505,000 | 57,500 | 562,500 | 6.3 | |

*For purposes of this example, we assume no retirement contributions and no state and local taxes assessed on employee compensation.

First, how do you calculate FTE = Full Time Employee (Equivalent)? The U.S. Treasury defines an FTE as any employee who works 40 hours per week or more. Each employee that on average, worked more than 40 hours per week during the particular calculation period, counts as one FTE. One employee cannot be greater than one FTE— overtime does not apply.

Any part-time employees that did not work more than 40 hours on average will have their average weekly hours worked added together, then Divide by 40 and round to the nearest tenth. For example, if you have 3 employees who consistently worked 20 hours a week, altogether they would count as 1.5 FTE.

Add your full-time FTE and your part-time FTE to get your total FTE figure.

For simplicity, when completing the forgiveness application, the SBA has alternatively allowed you to use 1.0 for any employee that works more than 40 hours a week, and 0.5 for all other employees. You may use either method of calculation, but the method must be consistently used. In our example we used the first method. E.G. Bob, in our example, worked 30 hours per week on average. You divide 30/40 = .75 round to .8.

On April 16th, the Company received a loan of $117,188 based on 250% of the 2019 average monthly compensation (~$562,500/12 x 2.5).

To continue with our Case Study:

- On January 1, AZ hired Grace at an annual salary of $50,000. On the same day, AZ let go of Henry for reasons not related to Covid-19 or the economy.

- On March 31st, AZ reduced salaries of the following employees:

- Bob $40,000

- Emily $90,000

- Grace $40,000

- On April 1st, Carla was let go as a result of the economic crisis

- Payroll period starts April 16th (which is also the date loan was funded so no alternative payroll period was chosen)

- On April 16th, Adam (the owner) increased his compensation to $150,000

- On June 15th, Carla was rehired at her original salary of $90,000

| For the Period 4/16/20 to 6/10/20 | |||||

| Employee | Annual Compansation/Salary | Actual Cassh Compensation Capped at $15,385 | 2019 Health Insurance | 2019 Avg Hours per Week | 2019 FTE Head Count |

| John (the owner) | 150,000 | 15,385 | 3,141 | 60 | 1.0 |

| Bob | 40,000 | 6,154 | 3,141 | 30 | 0.8 |

| Sarah | – | – | |||

| David | 30,000 | 4,615 | 3,141 | 20 | 0.5 |

| Emily | 90,000 | 13,846 | 3,141 | 45 | 1.0 |

| Frank | 80,000 | 12,308 | 3,141 | 45 | 1.0 |

| Gracy | 40,000 | 6,154 | 3,141 | 45 | 1.0 |

| Henry | |||||

| Totals | 430,000 | 58,462 | 18,846 | 5.3 | |

Note: the cap of $15,385 is calculated by taking $100,000/52 weeks and Multiplying it the eight-week employment period. However, for the same salary the PPP loan amount was calculated as $16,667 for an equivalent 8-week period (the PPP loan amount was based on a 10-week period).

- During the covered period (April 16th through June 10th), AZ had the following non-payroll related expenses: Rent on Building ($16,000):

- Paid $8,000 on May 1st

- Paid $8,000 on June 1st

- Equipment Leases ($4,000):

- Paid $1,000 on April 20th for lease from March 11th through April 10th

- Paid $1,500 on May 20th for lease from April 11th through May 10th

- Paid $1,500 on June 20th for lease from May 11th through June 10th

- Utilities ($5,200):

- Paid $2,600 on May 1st

- Paid $2,600 on June 1st

Payroll Costs including Loan Reduction Exceptions and Safe Harbors

In order to complete page 3 & 4, we need to first complete other parts of the application. In this section we will be discussing Payroll Costs including Loan Reduction Exceptions and Safe Harbors rules.

We need to complete page 6 – PPP Schedule A (here we will on concern ourselves with the portion of Schedule A dealing with Payroll). However, to complete this section we need to first complete Schedule A Work Sheet page 9. While Schedule A must be submitted with the loan forgiveness application (pages 2 &4). Page 9, the work sheet does not have to be submitted. The first part of schedule A covers cash compensation. Keep in mind that there are two pools of employees and two tables for cash compensation. Table one covers certain pool employees and then table 2 is going to cover the different set of employees.

However, you have to do an FTE for both. The first table is for employees earning less than $100,000. These employees may be subject to the salary and wage reduction. Table two is for employees earning over $100k and not subject to the salary and wage reduction.

However, to complete schedule A you will first need to complete Schedule A worksheet (pg. 9).

You see here that there are two pools of employees. Notice that these look a lot like the case study tables and information.

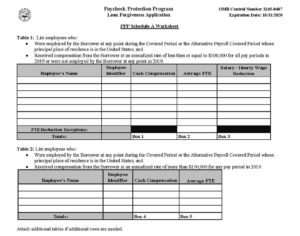

Next, we will discuss where we information to complete this worksheet. Table 1 is for those employees earning under a $100k per year. The requirements for employees in this table are:

- Were employed by the Borrower at any point during the Covered Period or the Alternative Payroll Covered Period whose principal place of residence is in the United States; and

- Received compensation from the Borrower at an annualized rate of less than or equal to $100,000 for all pay periods in 2019 or were not employed by the Borrower at any point in 2019. New employees in 2020 should be included in Table 1 regardless of their annualized salary

Cash Compensation goes into Box 1, FTE Average goes into Box 2 and Salary & Wage Reduction goes into Box 3.

For Table 2, which for employees earning over 100,000 annually, the requirements are:

- Were employed by the Borrower at any point during the Covered Period or the Alternative Payroll Covered Period whose principal place of residence is in the United States; and

- Received compensation from the Borrower at an annualized rate of more than $100,000 for any pay period in 2019.

Cash Compensation goes into Box 4, FTE Average goes into Box 5 and Salary & Wage Reduction –DOES NOT APPLY.

What goes into Boxes 1 & 4 – Cash compensations? As was discussed in part 1 of the article, cash compensation includes:

- Gross salary, wage, commission, or similar compensation;

- Payment of cash tip or equivalent;

- Payment for vacation, parental, family, medical, or sick leave; or

- Allowance for dismissal or separation.

What is not included in cash compensation is:

- The compensation of an individual employee in excess of an annual salary of $100,000, prorated over the covered period.

- maximum of $15,385 (~$100,000/52*8) per individual for Table 1 or Table 2.

- Any compensation of an employee whose principal place of residence is outside of the United States; or

- Qualified sick leave wages for which a credit is allowed under section 7001 or 7003 of the Families First Coronavirus Response Act (Public Law 116–127).

Boxes 2 & 5 deal with FTE (Table 1 & 2). We need to:

- Calculate the average full-time equivalency (FTE) per employee during the Covered Period or the Alternative Payroll Covered Period. We will discuss the alternative covered period later.

- For each employee, enter the average number of hours paid per week, divide by 40, and round the total to the nearest tenth.

- The maximum for each employee is capped at 1.0.

There is a “simplified method” for calculating the average FTE. As discussed earlier, this method involves assigning a 1.0 for employees who work 40 hours or more per week and 0.5 for employees who work fewer hours may be used at the election of the Borrower. It should be noted that the FTE Average concept also applies to the FTE Reduction. FTE Reduction Exception and Safe Harbor to be discussed later.

The last section of this form is the Salary/ Hourly Wage Reduction, AKA Box 3. This calculation is used to determine whether the Borrower’s loan forgiveness amount must be reduced concerning reductions in employee salary and wages for the covered period. Reduction applies if the salary or hourly wages of employees listed in Table 1 were reduced by more than 25% as compared to the period of January 1, 2020 through March 31, 2020. Salary/Hourly Wage Reduction is waived if borrower restores salary/hourly wage levels by June 30, 2020. Salary/Hourly Wage Reduction Safe Harbor to be discussed later.

Let us use our Case Study to see how Tables 1 & 2 would be completed. Step one is to determine the cash compensation for each employee paid during the 8-week covered period and Step 2 is to compute the average FTE for each employee. Just to review, for John, the owner, you divide the 30 hours worked by 40 hours per week and you get .75 FTE which is rounded up to .8.

What follows is the results of doing Step 1 & 2 using our case study and what “happened” in our case study during the cover period. At first glance it would appear that all the employees belong in table one. However, remember that Emily’s Salary was reduced from $110,000 to 90,000. Thus, Emily would go into Table 2. It also should be noted that Grace, who is a new employee, would be listed in table 1 enough though her salary for 2020 could go over a $100,000. As she has no 2019 income.

| For the Covered Period 4/16/20 to 6/10/20 | |||||

| Employee | Annual Compansation/Salary | Actual Cassh Compensation Capped at $15,385 | Health Insurance | Avg Hours per Week | FTE Head Count |

| Bob | 40,000 | 6,154 | 3,141 | 30 | 0.8 |

| Sarah | |||||

| David | 30,000 | 4,615 | 3,141 | 20 | 0.5 |

| Emily | 90,000 | 13,846 | 3,141 | 45 | 1.0 |

| Frank | 80,000 | 12,308 | 3,141 | 45 | 1.0 |

| Gracy | 40,000 | 6,154 | 3,141 | 40 | 1.0 |

| Totals | 280,000 | 43,077 | 15,705 | 4.3 | |

Step 3: For Table 1, Determine Wage Reduction:

- Calculate average annual salary during covered period

- Calculate average annual salary for Q1 of 2020

- Determine percentage of reduction

- If more than 25% reduction:

- Calculate the excess of the 25% reduction

- Annualize the amount (divide by 52 and multiply by 8)

| Table 1: | A | B | C |

| Employee | Average Salary during covered Period | Average Salary Q1 | Covered over Q1 |

| Bob | 40,000 | 60,000 | 66.67% |

| David | 30,000 | 30,000 | 100.00% |

| Frank | 80,000 | 80,000 | 100.00% |

| Gracy | 40,000 | 50,000 | 80.00% |

From the above table, only Bob had more then a 25% wage reduction. So, in Bob’s case, as you can see in the following table, 25% of $60,000 is $15,000. The actual reduction was $20,000 and therefore the excess reduction was $5,000. The potential annualized wage reduction amount based on the calculation in D point 2 above and is $769.

| Wage Reduction computation for Bob | |

| 25% of Q1 | 15,000 |

| Actual Reduction | 20,000 |

| Excess reduction | 5,000 |

| Annualized | 769 |

We now have sufficient information to complete Table 1 of the PPP Schedule A work sheet however, first we will discuss Loan Reduction Exceptions and Safe Harbor rules.

Loan Reduction Exceptions and Safe Harbors

Wage Reduction Safe Harbor

The first Safe Harbor is the Salary/Hourly Wage Reduction Safe Harbor applies if both:

- The average annual pay between February 15, 2020 and April 26, 2020 is greater than the average annual pay, as of February 15, 2020, and

- The average annual pay as of June 30, 2020 is greater than the average annual pay as of February 15, 2020

It is useful go over the exceptions and safe harbors available if any of the reductions apply. The first Safe Harbor is the salary hourly wage reduction Safe Harbor. This applies to borrowers that restore salary hourly wages to February 15, 2020 levels by June 30, 2020. So, if you reduced your salary levels during the cover period and then you restore them by June 30th to what they were on February 15th, then no salary hourly wage reduction applies. Thus, the safe harbor.

Let review the process. First, we compute the wage reductions safe harbor. Here are the Steps:

- Step 1: Determine average annual salary as of February 15th

- Step 2: Determine average annual salary for the period from February 15ththrough April 26th

- Step 3: If Step 2 is greater than Step 1, the safe harbor does not apply

- Step 4: Determine average annual salary as of June 30th

If Step 4 is NOT equal to or greater than Step 1, the safe harbor does not apply.

Now applying these rules to our case study, we see that Bob is the only one whose salary was cut by more than 25%. Our example is complicated by him receiving the pay cut on 3/16. Six 10ths of the way thru the period. We apply the safe harbor process to see if his salary qualifies for the safe harbor. As you can see from the table below, he does not. Keep in mind that purpose of step 4 is to see if he his salary was restored which is allowed under the safe harbor. In this case, he does not qualify and the company will have to reduce the amount of the loan forgiveness.

| Wage Reduction Safe Harbor for Bob: | ||||

| Step 1: | Salary 2/15/2020 | 60,000 | ||

| Step 2: | Average (Annual) Salary for 2/15 – 4/26: | |||

| Salary 2/15 – 3/15 | 60,000 | * | ||

| Salary 3/16 – 4/26 | 40,000 | ** | ||

| Average Salary | 52,000 | |||

| The total period is 10 weeks | ||||

| * Assume 6 weeks for the period 2/15 – 3/31 | ||||

| ** Assume 4 weeks for the period 4/1 – 4/26 | ||||

| Step 3: | The test: Is Step 2 Greater then Step 1? | |||

| If yes then the Safe Harbor does not apply. | ||||

| Step 4: | Salary 6/30/2020 | 40,000 | ||

| Because Step 4 is not equal to or greater then Step 1 | ||||

| The Safe harbor does not apply. | ||||

FTE Reductions & Safe Harbor

The next step in the process is to consider the FTE reductions and this is the 2nd safe harbor. An FTE Reduction Exception applies if the borrower:

- Made a good-faith, written offer to rehire an employee during the Covered Period or the Alternative Payroll Covered Period which was rejected by the employee; and

- Any employees who during the Covered Period or the Alternative Payroll Covered Period:

- were fired for cause,

- voluntarily resigned, or

- voluntarily requested and received a reduction of their hours.

It is important to keep in mind that properly document each situation and you must maintain records of it.

The second FTE safe harbor is that the FTE Reduction Safe Harbor also applies only if both of the following conditions are met:

- the Borrower reduced its FTE employee levels in the period beginning February 15, 2020, and ending April 26, 2020; and

- the Borrower then restored its FTE employee levels by not later than June 30, 2020 to its FTE employee levels in the Borrower’s pay period that included February 15, 2020.

Now let’s go to our case Study and apply the rules. In order to compute the FTE reduction safe harbor, you apply these steps:

- Step 1: Determine average FTE between February 15thand April 26th

- Step 2: Determine total FTE in pay period that covers February 15th

- Step 3: If Step 2 is NOT greater or equal to than Step 1, the safe harbor does not apply

- Step 4: Determine total FTE as of June 30th

If Step 4 is NOT equal to or greater than Step 3, the safe harbor does not apply.

What is not said is that the first thing you need to do is determine if you have an FTE reduction. In the following table you see that they had a head count reduction during the covered period.

| Employee | FTE 2019 | FTE 2/15/20 | FTE 4/1/20 | FTE 6/30/20 |

| John (the owner) | 1.0 | 1.0 | 1.0 | 1.0 |

| Bob | 0.8 | 0.8 | 0.8 | 0.8 |

| Sarah | 1.0 | 1.0 | – | 1.0 |

| David | 0.5 | 0.5 | 0.5 | 0.5 |

| Emily | 1.0 | 1.0 | 1.0 | 1.0 |

| Frank | 1.0 | 1.0 | 1.0 | 1.0 |

| Gracy | – | 1.0 | 1.0 | 1.0 |

| Henry | 1.0 | – | – | |

| 6.3 | 6.3 | 5.3 | 6.3 |

Then we will apply the steps above to see if he qualifies for the Safe harbor.

| FTE Reduction Safe Harbor: | |||||

| Step 1: | Average FTE for 2/15 – 4/26: | ||||

| FTE 2/15/20 – 3/31/20 | 6.3 | * | |||

| FTEs 4/1/20 – 4/26/20 | 5.3 | ** | |||

| Average FTE for period | 5.9 | ||||

| * assume 6 weeks for 2/15 – 3/31 | |||||

| ** assume 4 weeks for 4/1 – 4/26 | |||||

| Step 2: | Total FTE for pay period that includes 2/15 | 6.3 | |||

| Step 4: | Total FTE on 6/30 | 6.3 | |||

| Because Step 4 is equal to Step 3, the FTE Safe Harbor applies | |||||

Because Step 4 is equal to Step 3, the FTE Safe Harbor applies. If it did not apply the amount of loan forgives might need to be reduced.

Now we have the results from our work and complete page 9 of the application which follows.

This ends Part two of our Adventure in completing the SBA 3508 Loan Forgiveness Application. The next section will continue our adventure. MORE FUN TO FOLLOW.